Published on: October 20, 2022

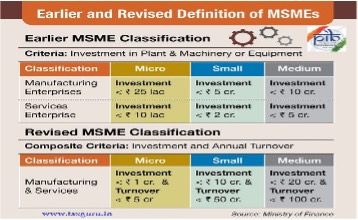

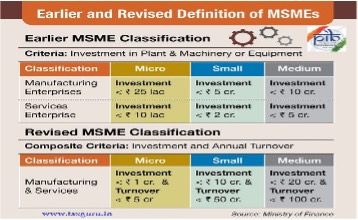

MSMEs can claim benefits post re-classification

MSMEs can claim benefits post re-classification

Why in news?

Micro, small and medium enterprises will continue to receive non-tax benefits for three years despite moving above the investment and turnover threshold.

Highlights

- There decision, the government believes, will incentivise MSMEs to invest and grow.

- In case of an upward change in terms of investment in plant and machinery or equipment or turnover or both, and consequent re-classification, an enterprise shall continue to avail of all non tax benefits of the category (micro or small or medium) it was in before the reclassification, for a period of three years from the date of such upward change,”

- They have remained ‘dwarfs’ fearing the loss of benefits if they invest more and grow beyond the threshold.

- Many MSMEs who are growing fast, fear the loss of certain non-tax though very critical benefits available to micro and small enterprises under the MSMED Act 2006.

- The government decision is a major incentive to all small enterprises.